Staying Match and Healthy With Planet Fitness

Jim Cramer informed his Mad Funds viewers Thursday evening that there is a bull current market in fitness afoot as people today search to lose their pandemic pounds. Cramer appeared at four different techniques to enjoy the development.

1st up was connected fitness giant Peloton (PTON) which was a enormous COVID winner in 2020, that has now turn into a battleground inventory in 2021. With shares off 21% for the 12 months, Cramer explained he is averting this just one.

Next was World Fitness (PLNT) , the very low-price, no-judgement fitness center that is choosing up prospects from the 17% of fitness centers that shut for the duration of the pandemic. Cramer continues to be a enthusiast.

Then there is certainly F45 Teaching (FXLV) , the fitness club for hardcore athletes that’s backed by Mark Wahlberg. With 1,800 spots and additional on the way, Cramer claimed he likes the financials and the exact-retail outlet profits advancement.

Last but not least, there’s Xponential Fitness, which is coming public currently.

Individually, I joined my area Orange Fitness Principle past thirty day period to get in condition but let us choose a search at Planet Fitness.

In this every day bar chart of PLNT, down below, we can see that costs have declined from the center of April. Charges are trading down below the declining 50-day shifting regular line and down below the however mounting 200-working day shifting typical line. The 50-working day line has crossed beneath the 200-day line for a useless or demise cross of these two indicators. This market signal will come well off the best and might be the incorrect signal to fork out attention to.

The On-Harmony-Quantity (OBV) line reveals a gradual decline from late February. The 12-day price tag momentum examine shows bigger lows from May well to July telling us that the tempo of the decrease is slowing. This is a bullish divergence as selling prices decrease while the indicator increases. This setup can foreshadow a restoration in selling price.

In this weekly Japanese candlestick chart of PLNT, beneath, we can see a potential hammer bottom reversal pattern – recognize the extensive decrease shadow? A bullish candlestick pattern this coming 7 days is wanted for confirmation.

The weekly OBV line reveals weak spot from April but there is a hint of improvement at the commencing of July. The MACD oscillator is pointed down but even now just higher than the zero line and narrowing.

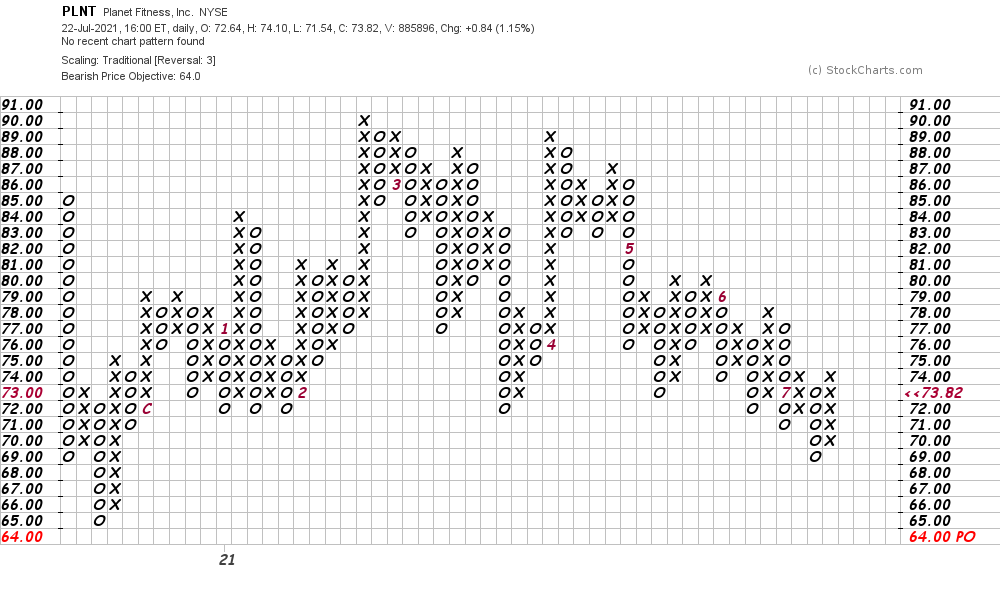

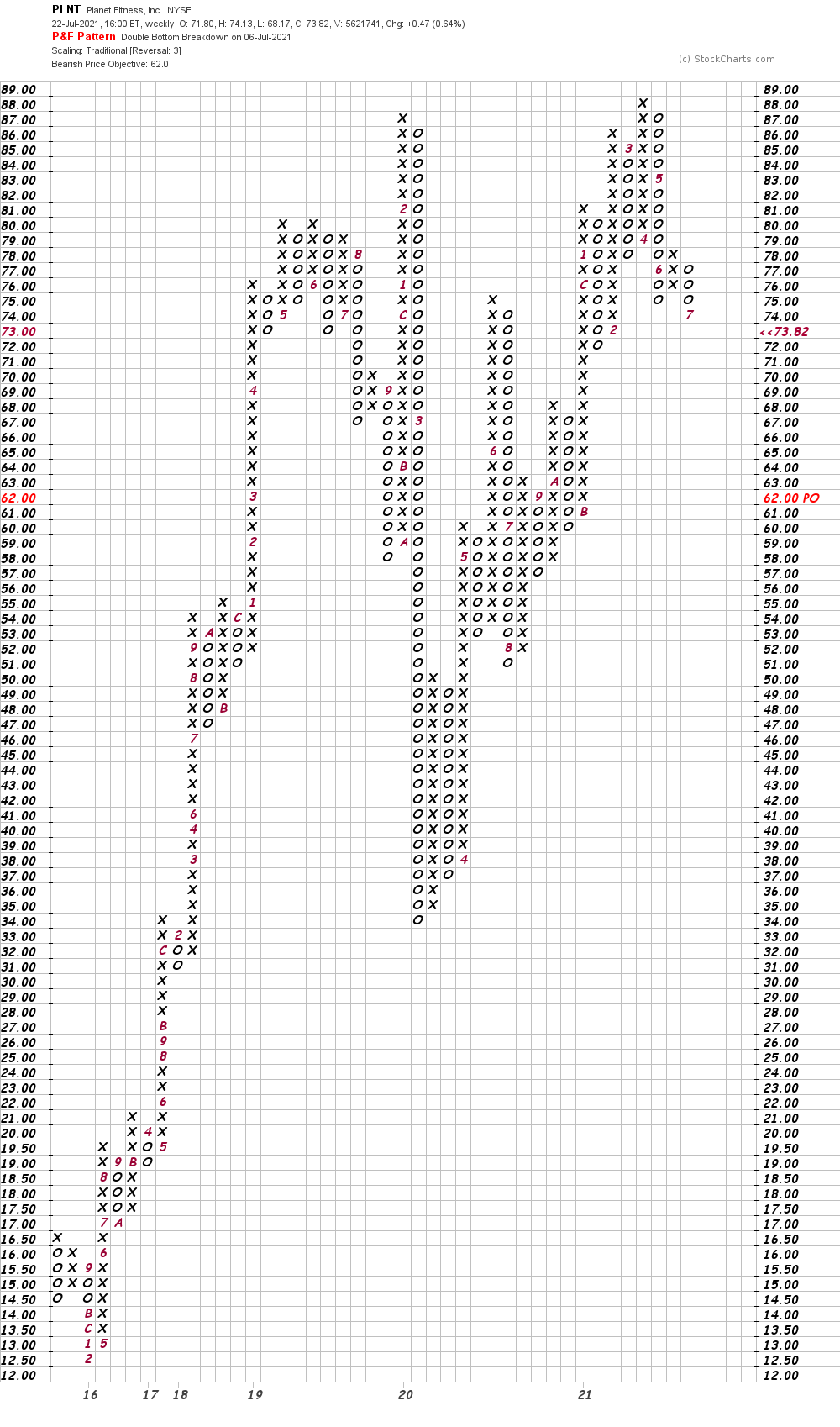

In this every day Issue and Figure chart of PLNT, below, we can see a feasible draw back cost focus on of $64 but a trade at $68 is wanted to refresh the downtrend.

In this weekly Point and Determine chart of PLNT, below, we made use of close only prices and here a $62 price tag goal can be found.

Base line technique: PLNT is nevertheless in a downtrend but momentum has been slowing, but a couple closes over $75 need to encourage additional gains. Intense traders could go extended PLNT on toughness above $76 jeopardizing to $68.